BNY MELLON

Streamlining a wealth management experience

Simplifying daily functions to enable advisers to spend quality time with their clients

Role

UI/UX Design Lead

Project type

SaaS platform

Client

BNY Mellon/Publicis Sapient

Timeline

December 2023 - March 2024

Challenge

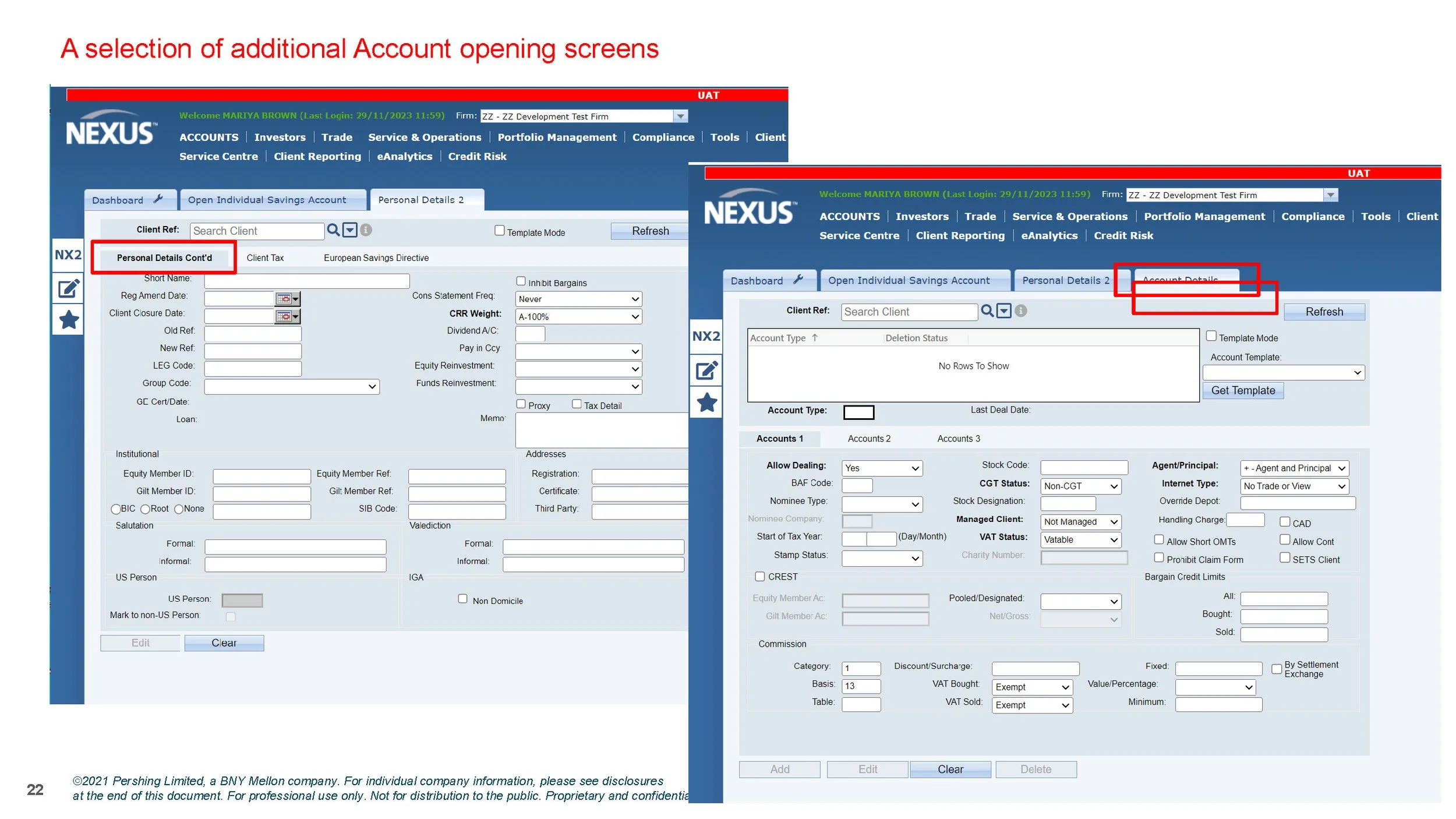

BNY Mellon’s adviser platform Nexus® was failing to meet advisers expectations for setting up investor accounts and came with a host of issues, causing delays in account opening, impacting client attraction and retention. Pain points included:

Outdated 20+ year old application requiring constant workarounds

Onboarding and maintenance processes were fragmented and inefficient

Manual data entry, inconsistent field structures, and legacy systems cause delays and errors

User journeys didn’t support the customisation needs of different client personas

UI/UX not intuitive or user-friendly

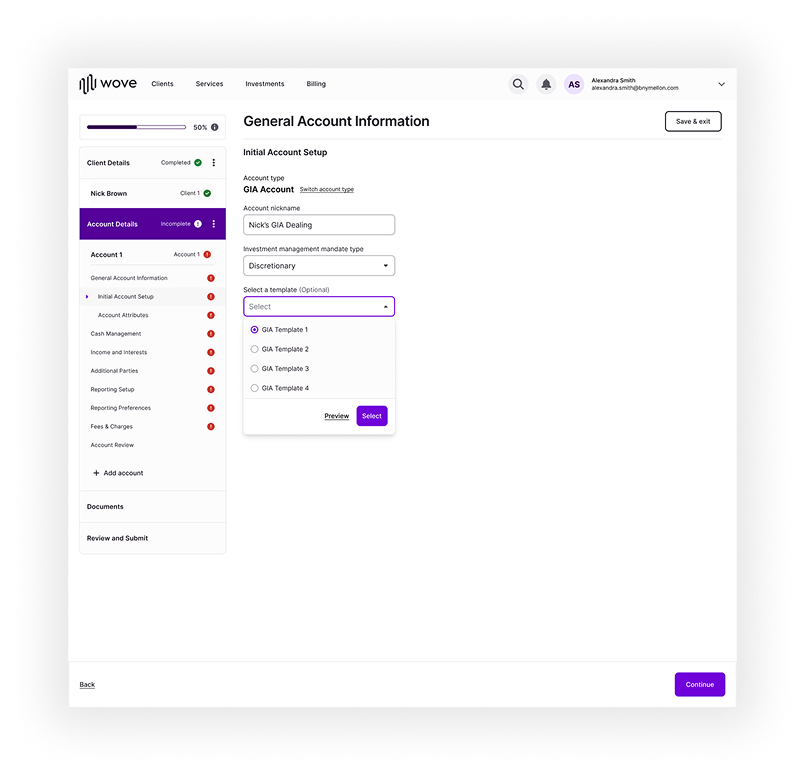

Nexus® wealth management adviser platform

Objectives

The goal was to enhance BNY Mellon’s clients customer retention and attract new prospects. To achieve this we aimed to improve the product UX/UI through the following objectives:

Create seamless, intuitive investor account opening journeys across multiple types

Develop design solutions, leveraging the award winning Pershing X Wove platform

Streamline internal processes and reduce manual interventions

Design a robust, scalable, and modern data architecture

Enable faster time-to-market for enhancements

Solution

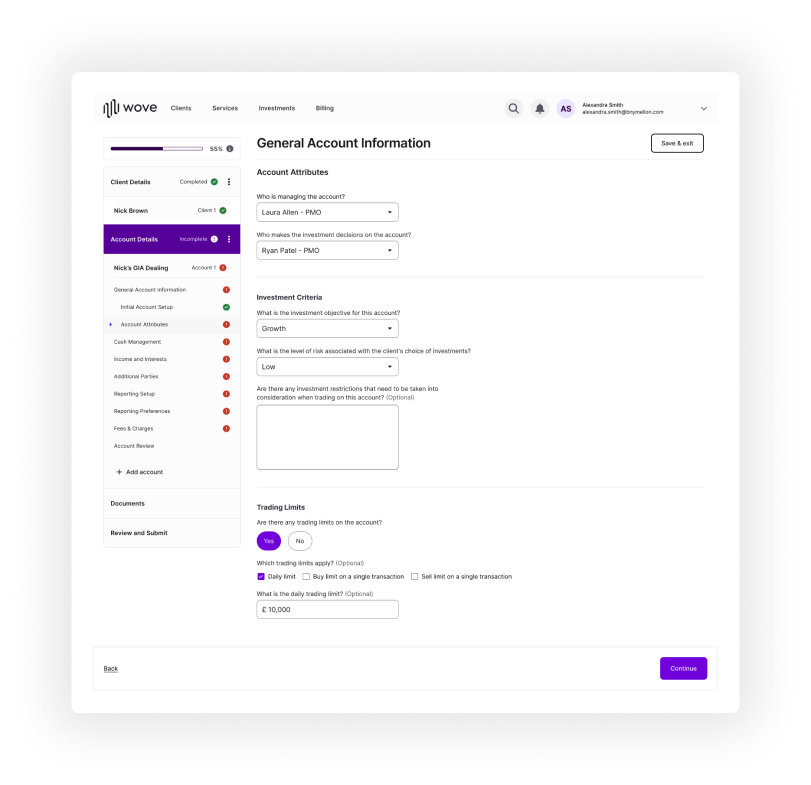

Through extensive user research, iterative design, and testing, the team created a dev ready product packed with user-centered optimised journeys and enhanced features that exceeded client expectations.

Simplified navigation to help reduce account onboarding complexity

Faster time to complete account opening

Guided journey design

Single & simplified data entry

Tailored user journeys

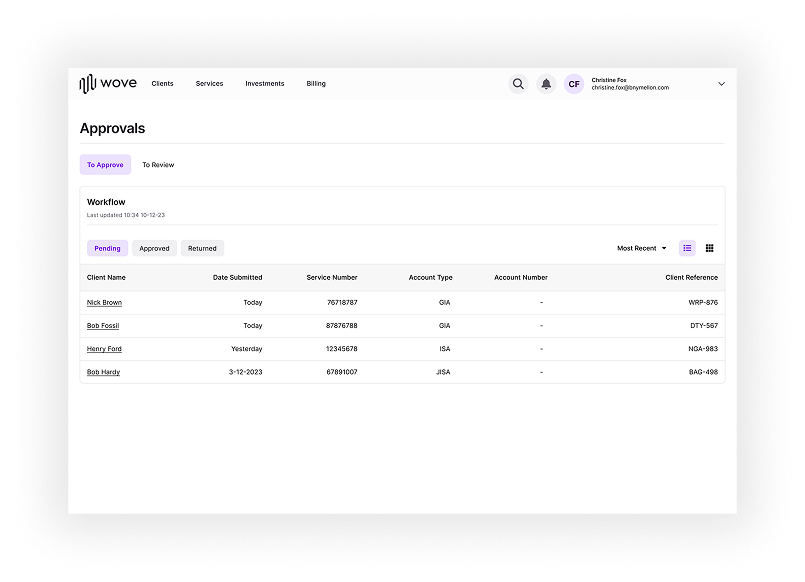

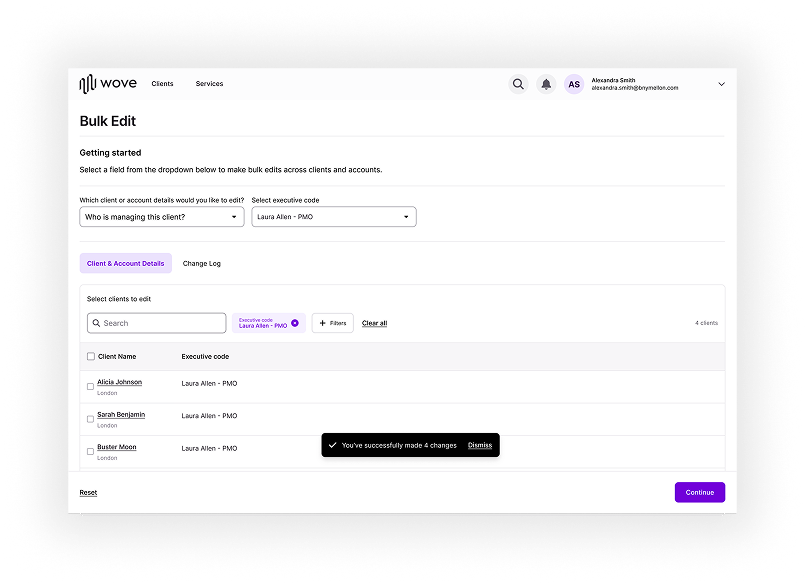

Additional product features

Approval tracking

to provide advisers the ability to log and track account applications.

Bulk editing

to provide the ability to select client or account details and edit across multiple clients or accounts.

Templates

were introduced to provide the ability to create, save, and access reusable data entry fields.

Business benefits

– Reduction in support requests and complains

– Reduction in technology complexities

– Design System foundational components to support efficient and scalable future platform enhancements

The Design Process

I lead the design approach through gathering insights to help drive a user-centered product solution.

Discovery

User research

Competitor analysis

Stakeholder interviews

Design

Journey mapping

Wireframes

Prototypes

Test

Usability testing

Design iterations

Finalise design

Discovery

A comprehensive set of discovery sessions were run over the course of 20 weeks. Feedback was shaped into actionable insights to inform new user journeys and UX/UI design.

14

Client interviews

20

Stakeholder interviews

600

Pages reviewed

650

Input fields assessed

Key findings

Research was undertaken with four of BNY Mellons clients to understand user needs and pain points of using the Nexus platform. A synthesis of data surfaced 8 core pain points which translate into implications and opportunities for the future state journey.

“There are so many old fields that aren’t really needed, and most aren’t even relevant to corporate accounts”

“To update the address for one person we have to update manually across all their accounts”

“We manually assign people to check all of the fields before we open the account which can take up to 48 hours"

Competitive analysis

We researched businesses that demonstrated best-in-class UX/UI to provide inspiration and help construct a set of design principles.

TurboTax, H&R Block & Capital One

Frequently referenced best in class onboarding process

Parmenion

Referenced by clients

Wove

Pershing X owned US platform

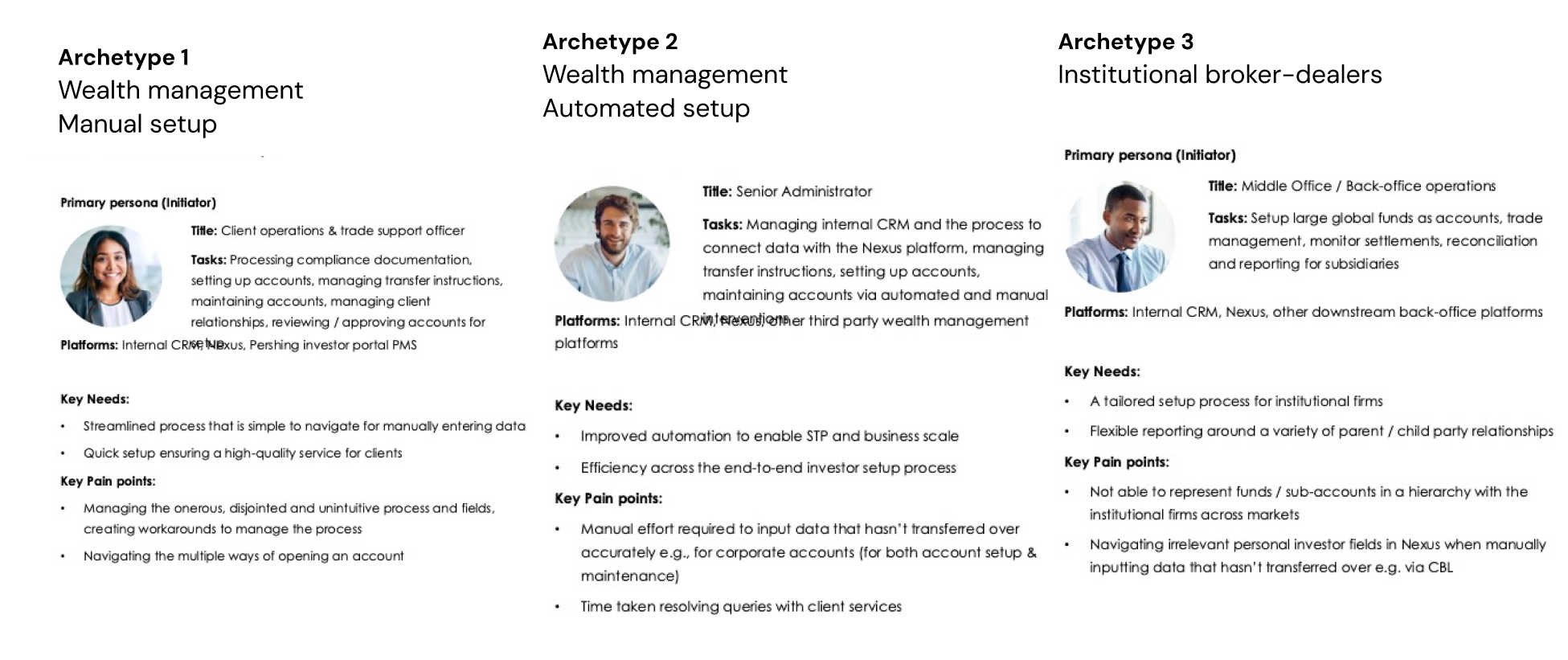

Adviser archetypes

Updated archetypes were created to represent what user needs, goals, and behaviours were based on completing investor setups and maintenance tasks.

Design

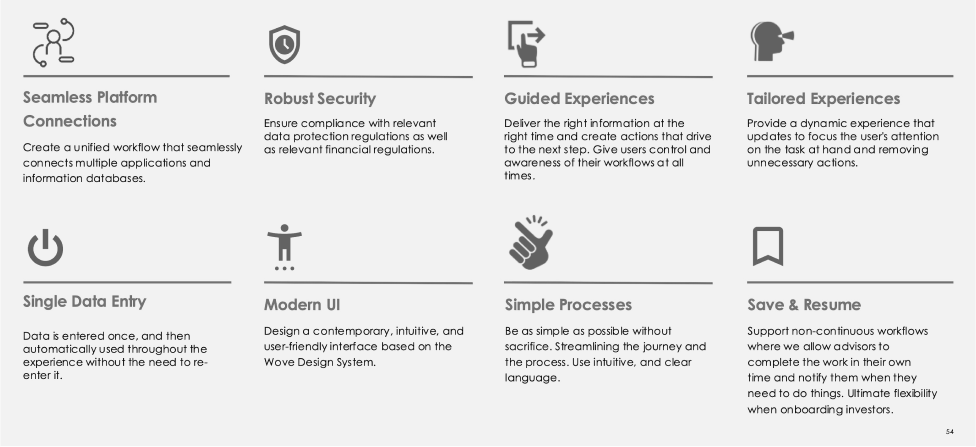

UX/UI principles

I worked with the CX lead and stakeholders to define a set of design principles. These acted as a shared set of rules and values that helped guide decision-making and ensure consistency across the product.

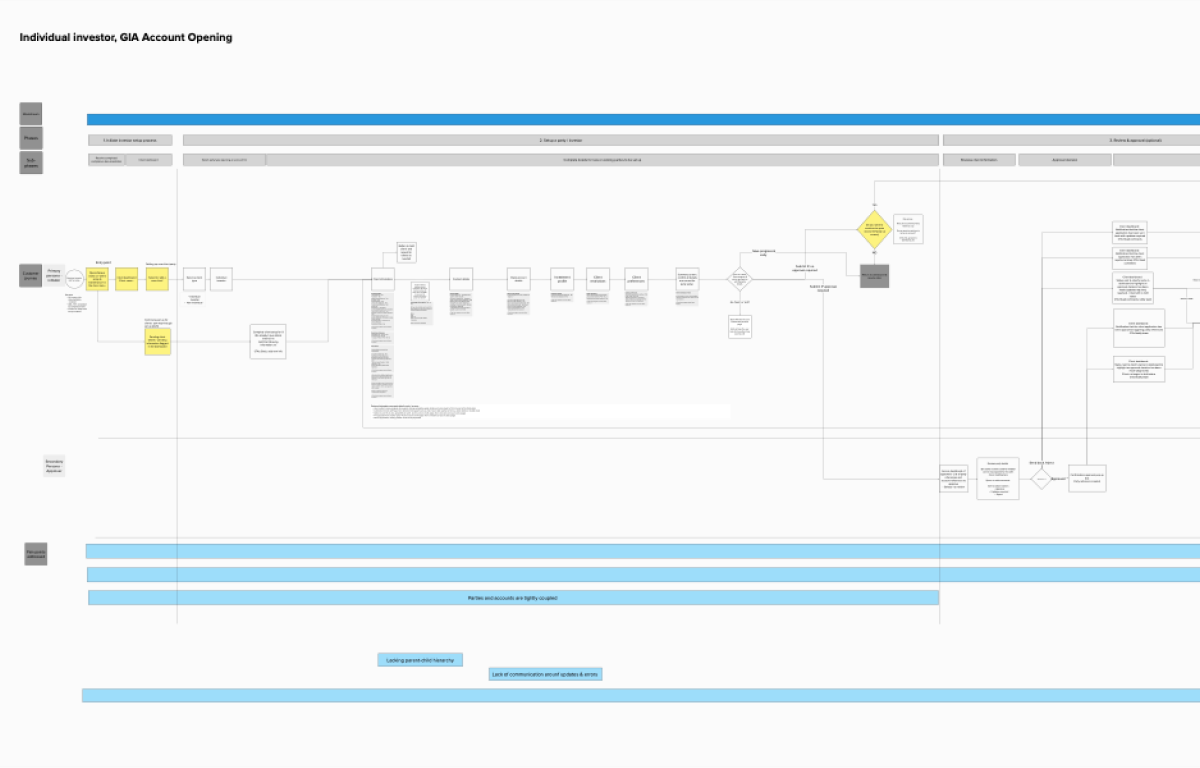

Journey maps

Journey maps were created based of a 6-week discovery phase of work to concept out updates to account opening flows.

Hi-fidelity journey prototypes

Using the journey maps as the guiding framework, we used the Wove design system to build out hi-fidelity journey prototypes for each account opening journey and maintenance journeys.

The team and I completed 11 user journeys that included:

• 8 account types (GIA, ISA, SIPP etc.)

• 3 new maintenance paths (templares, bulk edits, approval flows)

We planned to test ‘happy path’ journeys with the original group of users to gain insights to help shape the final designs. These user journeys aimed to benefit over 80% of the client base.

GIA account opening journey

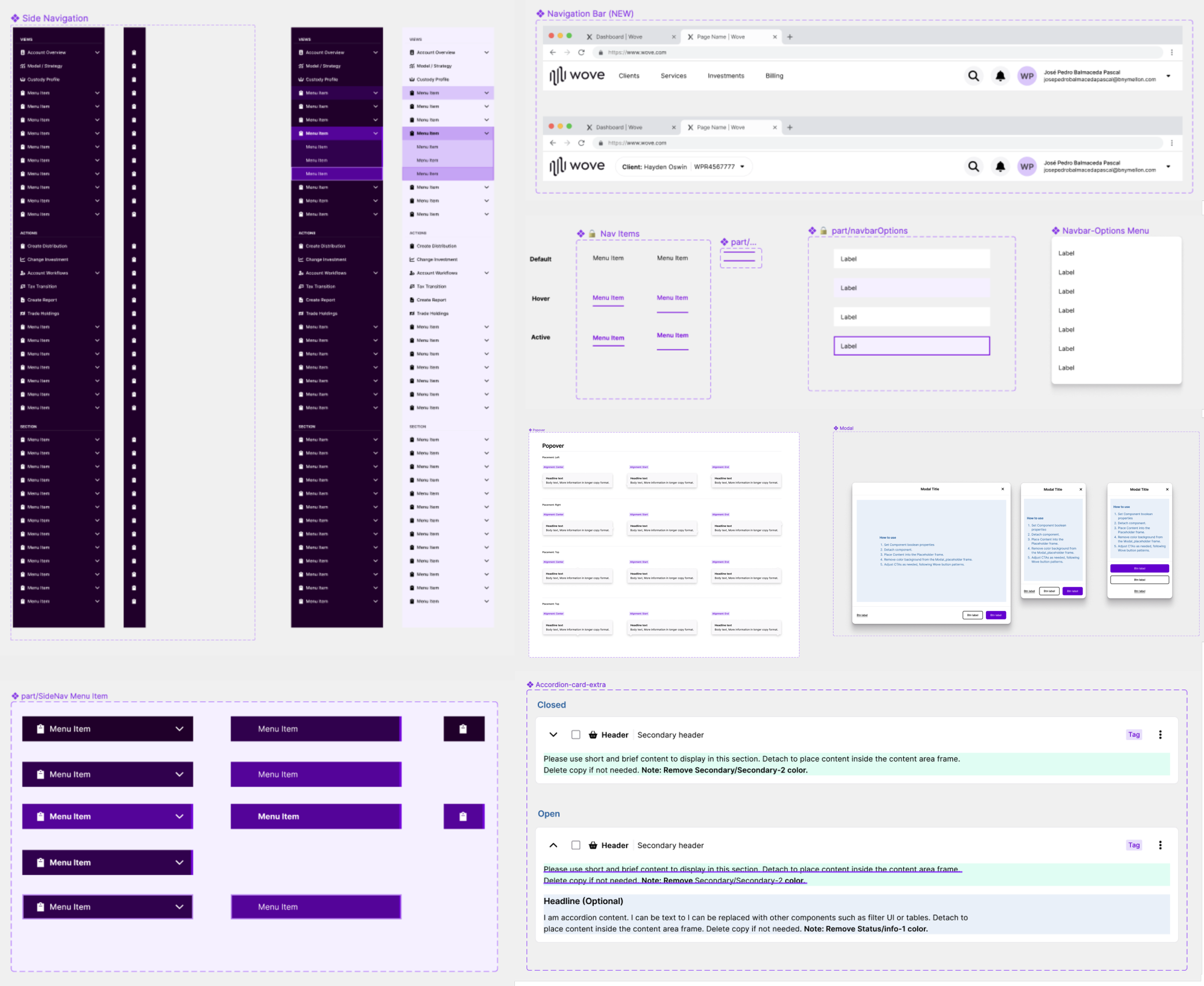

Wove design system

The Wove design system provided a rich foundation of core components from which I developed core user flows that the team and I developed into hi-fidelity prototypes for usability testing.

Test

Usability test method & objective

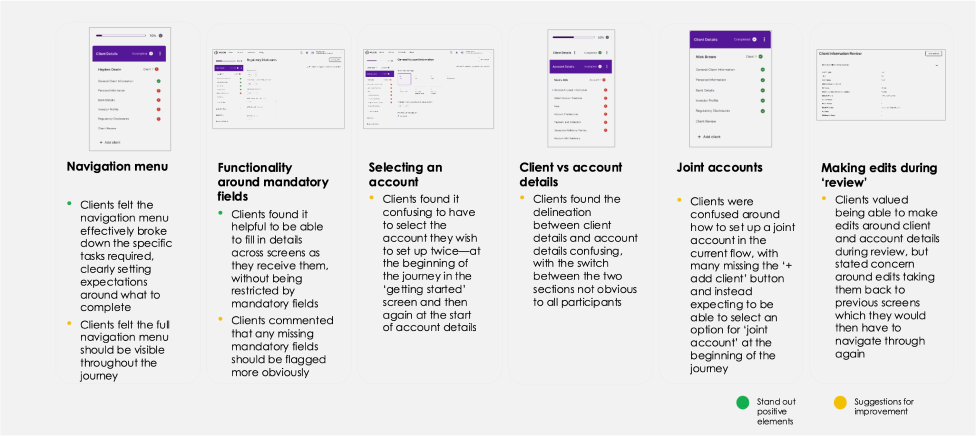

We conducted virtual online 1:1 interviews with 4 of Pershing’s key clients to test manual entry journey flows.

Our research objectives were to gauge reactions around the core account opening journeys we had developed and whether the content and flow was useful and facilitated effective progression through account opening. In addition we aimed to understand:

How well we had addressed the clients pain points

If we were successful in mapping journeys to the design principles

If journeys were aligned with the client’s workflow and the data they collect

Results & findings

Overall clients felt the journey was much clearer and simpler to navigate through, with targeted areas of focus for further improvement

Journey navigation and flow

Clients found the journey simple, clear and logical to navigate through, but felt some of the core components of the journey should be better signposted, e.g. client details vs account details, and joint accounts.

Project team

Principle strategist Andrew Tan

CX&I manager Emma Kenworthy

Product director Prateek Kulshreshtha

Product manger Ravi Bardia

UX/UI design lead Tim Wolf

UX designer Hannah Yong

UI designer Tian Huang

Data strategy director Ashis Patel

Data strategist Kamalendu Chatterjee

Data strategist Mayur Sharma

Project responsibilities

Conceptual journey flows

User journey mapping

User personas

Usability testing

Wireframing

UX/UI design

Prototyping (Figma)

Design team management

Design system management